To Create An Export Format

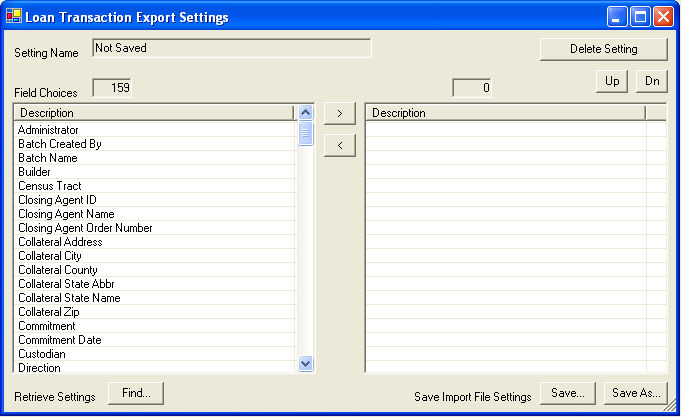

Click create export format. The box below will appear. From the list on the left, select the fields that you want exported.

Highlight the field then use the > arrow key to move the field to the right. The fields will appear in the export in the order they show on the right. If you need to move a field up or down, highlight the field and click up or down until the field is in the correct position.

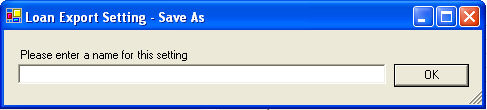

Once the setting is complete click save as and the box below will appear.

Enter the name for the setting and click ok.

If you make any changes to the setting, click save to retain the changes.

To view existing settings, click find and a list of all reports will be displayed.

Close this box to continue with the export process.

To Export Transactions

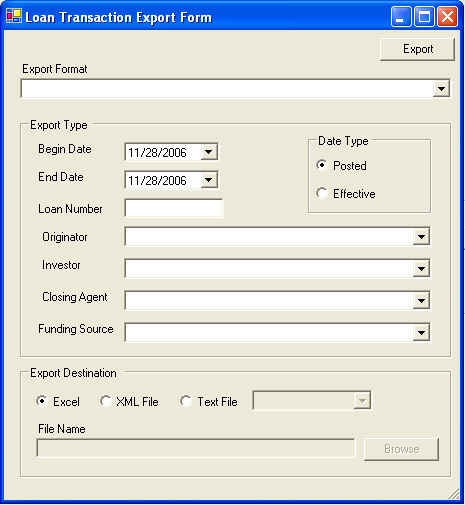

Click export TRANSACTION INFORMATION to begin the export process. The box below will appear.

Use the drop box to select the export format.

Select the date or date range of the transactions.

Select either the "posted" or "effective" date of the transactions.

Enter a loan number if you are looking for transactions related to a specific loan.

Use the "originator", "investor", "closing agent", "funding source" and/or "investor" if you want transactions related to a specific company.

Select the export destination.

When all information has been selected, click export.

Export Field Field Description

|

Administrator |

Administrator |

|

Batch Created By |

User ID of who created batch |

|

Batch Name |

Batch name |

|

Builder |

Builder |

|

Census Tract |

Census tract |

|

Closing Agent ID |

Closing Agent ID |

|

Closing Agent Name |

Closing Agent name |

|

Closing Agent Order umber |

"order" field from Add-Edit |

|

Collateral Address |

Property address |

|

Collateral City |

Property city |

|

Collateral County |

Property county |

|

Collateral State Abr |

Property state abbreviation |

|

Collateral State Name |

Property state name |

|

Collateral Zip |

Property zip code |

|

Commitment |

Investor commitment number |

|

Commitment Date |

Requested date |

|

Custodian |

Custodian |

|

Direction |

upstream or downstream |

|

Disbursement Amount |

Disbursement amount (original) |

|

Disbursement Effective Date |

Disbursement Effective date |

|

Disbursement made to |

Closing Agent or Originator |

|

Disbursement Method |

Wire, check, DDA or other |

|

Disbursement Posted Date |

Disbursement posted date |

|

Effective Date |

Effective Date of transaction |

|

Funding Source ID |

Funding Source ID |

|

Funding Source Name |

Funding Source Name |

|

Funding Source Product Code |

Funding Source product code |

|

Funds Borrowed Amount |

Funds Borrowed Amount (original) |

|

Funds Borrowed Basis |

360 or 365 |

|

Funds Borrowed Index |

Upstream index |

|

Funds Borrowed Margin |

Upstream margin |

|

Funds Borrowed Percent |

Funds Borrowed percent (original) |

|

Funds to Send |

Funds to send |

|

FundsBorrowedDate |

Effective date of funds borrowed |

|

Interest Expense |

Interest Expense |

|

Interest Income |

Interest Income |

|

Investor ID |

Investor ID |

|

Investor Name |

Investor Name |

|

Investor Product Code |

Investor product code |

|

Loan Number |

Loan number (ID) |

|

Loan Size Margin |

value of LS rule in effect at time of disbursement |

|

Loan Status |

current loan status |

|

MERS MIN |

MERS MIN number |

|

MERS MIN Verified by User |

check box - checked = yes |

|

Mortgage Insurance Company |

MI company |

|

Mortgage Insurance Premium |

MI Premium |

|

Mortgage PI Pmt |

P&I amount |

|

Mortgage Servicer |

Servicer |

|

Mortgagee Loan Name |

Mortgagee Loan Name |

|

Mortgage Pmt First Due Date |

First payment due date |

|

Mtg Pool |

Pool number |

|

NonAccrual |

check box - checked = yes |

|

Note Amount |

Note amount |

|

Note Date |

Note date |

|

Note Location Since Date |

Note at current location since date |

|

Note Rate |

Note Rate |

|

Note Received Date |

Note received date |

|

Note Ship to Investor by User |

User ID of who shipped note to investor |

|

Note Ship to Investor Date |

Date note shipped to investor |

|

Note Ship to Investor Name |

Investor name |

|

Note Ship to Investor Tracking No |

Tracking number |

|

Note Term |

Note term |

|

Note Value - not implemented |

NOT IMPLEMENTED AT THIS TIME |

|

Originator Basis |

360 or 365 |

|

Originator ID |

Originator ID |

|

Originator Index |

Index name |

|

Originator Loan Number |

"account number" field |

|

Originator Margin |

Originator margin |

|

Originator Name |

Originator name |

|

Originator Participating |

Check box - checked = yes |

|

Originator Participation Amount |

Originator participation amount |

|

Originator Product Code |

Originator product code |

|

Other |

Other amount |

|

Participant |

Participant |

|

Payment or Charge |

c = charge / p = payment |

|

Posted Date |

Posted date of transaction |

|

Premium Discount |

Premium discount |

|

Same Day Fee |

check box - checked = yes |

|

Secondary Funding Source ID |

Secondary Funding Source ID |

|

Secondary Funding Source Name |

Secondary Funding Source Name |

|

Secondary Funding Source Product Code |

Secondary Funding Source Product Code |

|

Seller |

Seller |

|

Settlement Amount Applied |

Settlement amount applied to this loan |

|

Settlement Effective Date |

Settlement effective date |

|

Settlement Method |

Wire, check, DDA or other |

|

Settlement on Date |

Settlement on date |

|

Settlement Originator Residual |

Originator residual |

|

Settlement Posted Date |

Settlement posted date |

|

Settlement Warehouse Income |

Warehouse income |

|

Takeout Amount |

Investor takeout/commitment amount (percent) |

|

Takeout Expiration Date |

Investor takeout/commitment expiration date |

|

Takeout In File |

check box - checked = yes |

|

Total Fee Charges - Downstream |

Total fee charges - downstream |

|

Total Fee Charges - Upstream |

Total fee charges - upstream |

|

Total Fee Payments - Downstream |

Total fee payments - downstream |

|

Total Fee Payments - Upstream |

Total fee payments - upstream |

|

Total Fees - Downstream |

Total fees - downstream |

|

Total Fees - Upstream |

Total fees - upstream |

|

Total Interest Payments - Downstream |

Total interest payments - downstream |

|

Total Interest Payments - Upstream |

Total interest payments - upstream |

|

Total Orig Participation Transactions |

Total originator participation transactions |

|

Total Principal Transactions - Downstream |

Total principal transactions - downstream |

|

Total Principal Transactions - Upstream |

Total principal transactions - upstream |

|

Total WH Participation Transactions |

Total warehouse participation transactions |

|

Transaction Amount |

Transaction amount |

|

Transaction Code |

Transaction code |

|

Transaction Sub Code |

Transaction sub code |

|

Transaction Type |

Transaction type |

|

UW Amortization Type |

Amortization type |

|

UW Appraisal Date |

Appraisal date |

|

UW Appraisal Type |

Appraisal Type |

|

UW Appraised Value |

Appraised Value (FMV) |

|

UW Appraiser |

Appraiser |

|

UW Approved |

check box - checked = yes |

|

UW Approved By |

User ID of who approved loan |

|

UW Approved Date |

Approved date |

|

UW Acquisition Cost |

Acquisition cost |

|

UW ARM Adjustment Freq |

ARM Adjustment frequency |

|

UW ARM Margin |

ARM Margin |

|

UW ARM Max Rate Lifetime |

ARM Max rate lifetime |

|

UW ARM Negative Amort Limt |

ARM negative amortization limit |

|

UW ARM Payment Cap Annual |

ARM payment cap annual |

|

UW ARM Rate Cap After First |

ARM rate cap after first |

|

UW ARM Rate Cap First |

ARM rate cap first |

|

UW Auto Underwriting Score |

Auto underwriting score |

|

UW Balloon |

Check box - checked = yes |

|

UW Borrower Cash Reserves |

Borrower cash reserves |

|

UW Borrower Present Job Length |

Borrower present job length |

|

UW Borrower Self Employed |

Check box - checked = yes |

|

UW Cash Out Amount |

Cash out amount |

|

UW CLTV |

CLTV |

|

UW Credit Grade External |

Credit grade external |

|

UW Credit Grade Internal |

Credit grade internal |

|

UW Debt Credit Score |

Credit score |

|

UW Debt Quality Ratio 1 |

Debt ratio 1 (front end ratio) |

|

UW Debt Quality Ratio 2 |

Debt ratio 2 (back end ratio) |

|

UW Documentation Type |

Documentation type |

|

UW Gross Income |

Gross income |

|

UW Lien Position |

Lien position |

|

UW Loan Type |

Loan type |

|

UW LTV |

LTV |

|

UW Mtg Insurance Coverage |

MI Coverage |

|

UW Occupied Code |

Occupancy |

|

UW Origination Source |

Acquisition Source |

|

UW Other Liens |

Other Liens |

|

UW Piggyback |

Check box - checked = yes |

|

UW Property Type |

Property type |

|

UW Rate Type |

Rate type |

|

UW Refinance Prior Note Date |

Refi - prior note date |

|

UW Refinance Prior Sales Price |

Refi - prior sales price |

|

UW Refinance Purpose |

Refi purpose |

|

UW Sales Price |

Sales price |

|

UW Transaction Type |

Transaction type |

|

UW Valuation Type |

Valuation type |

|

Volume Incentive Margin |

Volume incentive margin |

|

Warehouse Participation Amount |

Warehouse participation amount |

|

Warehouse Participation Percent |

Warehouse participation percent |

|

Warehouse Principal Amount |

Warehouse principal amount |

|

Warehouse Principal Percent |

Warehouse principal percent |